How Much Money Do Lottery Winners Get A Month

Lottery Payout Options

Before lottery winners can collect jackpots, they must usually make one important decision: Should they collect their winnings all at once or over a long menstruation of time?

The outset option is called a lump-sum award. That'due south when the winner receives all of the lottery winnings after taxes at in one case.

The 2d option is an annuity. Although annuities established past the lottery commissions accept been informally dubbed "lottery annuities," in reality, annuity contracts created for the purpose of distributing prize coin typically autumn under the safest category of annuities: fixed immediate.

Each state and lottery company varies. Powerball, for case, offers winners the selection of a lump-sum payout or an annuity of 30 payments over 29 years. Mega Millions offers lump-sum payouts or annuities. The annuity offers an initial payment followed by 29 almanac payments. Each payment is 5 percent larger than the previous one.

Did you know?

Lottery winning payments fabricated using annuities are sometimes referred to as "lottery annuities," but they are actually structured equally menses-certain fixed firsthand annuities backed by the U.Southward. government.

Lump Sum vs. Annuity for Lottery Winners

While both options guarantee a lottery payout, the lump-sum and annuity options offer different advantages. Choosing a lump-sum payout tin can help winners avert long-term tax implications and also provides the opportunity to immediately invest in high-yield financial options similar real manor and stocks.

Fact

Electing a long-term annuity payout can accept major tax benefits.

Federal taxes reduce lottery winnings immediately. But winners who take annuity payouts tin come closer to earning advertised jackpots than lump-sum takers.

Consider the case of $228.four million Powerball jackpot winner Vinh Nguyen, a California smash technician and sole top-prize winner of that game's drawing on Sept. 24, 2014.

Most big-prize winners opt for the lump sum. That would have been $134 million. Instead, Nguyen opted for the annuity. That will requite him the full $228,467,735 jackpot paid out over 30 years.

Those payments include interest that will accrue from investments over the life of the annuity.

Annuities also protect winners who might otherwise spend everything afterward a lump-sum payment.

Some winners may squander their funds all at once or non invest it properly, leading them to defalcation or other financial troubles.

An annuity isn't for anybody. Annuities are inflexible, prohibiting winners from changing the payout terms in the case of an unexpected financial or family emergency.

The almanac payments may prevent a winner from making large investments. Such investments generate more cash compared to the amount of interest earned on the annuities.

Winners Face Tax Issues

Taxes as well influence many lottery winners' decisions on whether to choose a lump-sum payout or an annuity. The reward of a lump sum is certainty — the lottery winnings will be subjected to current federal and state taxes every bit they exist at the time the money is won. Once taxed, the coin can exist spent or invested every bit the winner sees fit.

The reward of the annuity is the exact reverse — doubt. Every bit each annuity payment is received, it will exist taxed based on the and so-current federal and state rates. Those who choose the annuity pick for tax reasons are often betting that tax rates in the future will be lower than the current rates. However, should they regret their decision in choosing an annuity payout, lottery winners do accept the option of selling their annuity payments for a discounted lump sum.

Reasons for Selling Your Structured Settlement

Can I Sell My Lottery Annuity?

If you are interested in selling some or all of your annuity payments, you should contact your lottery company to clarify if the annuity can be sold.

Expand

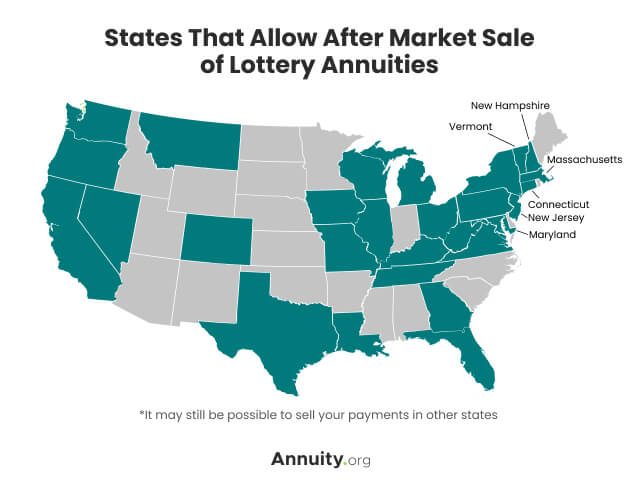

At that place are currently 28 states that permit after-marketplace sales of lottery annuities for a lump-sum payment.

Winners as well can determine to sell all or part of their futurity payments. The terms of the auction, including the full corporeality, are up for negotiation.

The lottery winner must have court approval for the transaction to take place. A judge decides whether such a sale is in the person's best involvement.

See what your time to come payments could be worth in cash

Turn your time to come payments into greenbacks you tin use right at present. Become started with a free judge and see what your payments are worth today!

How Much Is My Lottery Annuity Worth?

If you want an guess of the sales value of your lottery annuity, y'all can enter the information from your contract into this annuity figurer to get a custom quote that we stand backside.

How to Discover the Present Value of an Annuity

What Happens to My Lottery Annuity When I Die?

In spite of rumors that the government gets to continue the money, lottery annuities are generally passed to the winner's heirs. In fact, some lottery companies permit for a transfer of the funds only when the annuity possessor dies. In this instance, any remaining avails volition be disbursed to the estate or a living casher until their death or the end of the contract.

Some lotteries will cash out an annuity prize for an estate, to make it easier for the estate to distribute the inheritance and to pay federal manor taxes when they employ. In order for the lottery to do this, information technology has to be allowed in the land where the ticket was purchased.

The Process of Selling Annuity Payments

Lottery winners who decide to sell their periodic payments must first larn if they are allowed to do and so. That is often determined past the land in which the lottery was won and not by the state in which the lottery winner lives. Sometimes at that place are means of finding a loophole, a task all-time suited for a personal chaser.

Who Buys Lottery Payments?

Typically, ii types of companies buy long-term lottery payouts: factoring companies and insurance companies. These are the same companies that purchase settlements from sellers who collect personal injury settlements, mortgage notes and other kinds of long-term payouts.

Factoring companies offer lottery winners immediate cash for their annuity contracts. They are buying the lottery winner's futurity payments. The greenbacks payment is less than the total of the scheduled annuity payments.

The visitor should offer you a quote in writing at no charge.

The annuity purchasing companies are part of a very competitive, heavily regulated market. Inquire the visitor where they are certified and licensed and how long the quote is skilful. Ask most whatsoever fees and how long the company has been in business.

When selecting a buying visitor, information technology's unremarkably best to look for a company with feel and that has people who take the time to explain the written offering. Do not cavern to pressure level to sign something before you lot fully empathize and concord.

The company you choose will draft a contract detailing the proposed agreement. The proposal has to be canonical by a judge, who will determine if it is in the all-time interests of the lottery winner. The annuity purchasing company will have the contract to the gauge.

We recommend our partners, who accept been vetted past experts in the field. They have helped thousands of people who need to get cash quickly.

Tax Obligations of Selling Lottery Payments

Someone who cashes in some or all future lottery payments volition owe federal income taxes. This differs from the sales of structured settlements from personal injury lawsuits. In those cases, buyouts are revenue enhancement-gratis.

Please seek the advice of a qualified professional person before making fiscal decisions.

Last Modified: April 25, 2022

5 Cited Enquiry Articles

Annuity.org writers adhere to strict sourcing guidelines and utilize only apparent sources of data, including authoritative financial publications, academic organizations, peer-reviewed journals, highly regarded nonprofit organizations, government reports, court records and interviews with qualified experts. You can read more than about our delivery to accurateness, fairness and transparency in our editorial guidelines.

- Fernandez, L. (2014, Sept. 26). Nail Technician Wins $228M Powerball Ticket, Wants to Remain "Normal Human." Retrieved from https://world wide web.nbcbayarea.com/news/local/nail-technician-wins-228m-powerball-lottery-ticket-normal-san-mateo-fundamental-market/2075389/

- Powerball.com. (2014, Sept. 24). San Mateo $228.four Million Jackpot-Winning Powerball® Ticket Claimed! Retrieved from https://www.powerball.com/alphabetize.php/es/node/536

- Pinckard, Cliff. (2014, Sept. 25). Winning Powerball ticket sold in California; Ohio Lottery numbers for Thursday. Retrieved from https://www.cleveland.com/metro/2014/09/winning_powerball_ticket_sold.html

- Megamillions.com. (n.d.). Difference Between Greenbacks Value and Annuity. Retrieved from https://world wide web.megamillions.com/deviation-between-cash-value-and-annuity

- Wolff-Isle of mann, E. (2017, Aug. 23). Should Powerball Jackpot Winners Take the Annuity or the Lump Sum? Retrieved from https://coin.com/powerball-lottery-annuity-or-lump-sum/

Source: https://www.annuity.org/selling-payments/lottery/

Posted by: smithweriatere.blogspot.com

0 Response to "How Much Money Do Lottery Winners Get A Month"

Post a Comment